Some universities are famous for spawning leaders. Harvard and Wharton are global names. West Point is synonymous with military leadership. Dynastic families also adorn the historical records of countries and industries alike. Few are unfamiliar with the Morgans or Rothschilds in finance. But most don’t consider that companies have similarly long-dated impacts. Most acknowledge the influences of Goldman Sachs or JP Morgan, but few take note of the tendency for the alums of certain institutions to proliferate and dominate entire spheres of the economy. Yet we believe this is occurring in the fintech world, and startups are the agents of such change.

The world is familiar with the PayPal Mafia. PayPal changed how money moves around the globe, generating dramatic wealth and better customer experiences in the process. But PayPal’s most lasting impact stems from the leaders that graduated from its ranks. Elon Musk went on to found Tesla, SpaceX, and a growing empire of firms. Peter Thiel later seeded Facebook, built Founders Fund, and launched the Thiel Fellowship. Max Levchin founded Affirm. Reid Hoffman built Linkedin and Greylock. The list is so long, and the grouping so uniquely successful, that in 2007, Fortune Magazine popularized them as the “PayPal Mafia”.

But is PayPal the only example? At Gilgamesh Ventures, we’ve suspected for a while, and often noticed, that similarly powerful groupings of people exist elsewhere, with less fanfare. So in the last few months, in partnership with The Wharton School of Business as part of a class led by professor Dave Erickson, we decided to answer the question conclusively, as to whether this happens in fintech. As expected, it does and we at Gilgamesh Ventures are excited to pass along our findings with the help of Wharton MBAs Kirstie Irmana, Kris Jenk, and Josh Jagota.

My co-founder, Andrew Endicott, and I sat down last week to talk about some of our learnings and the implications of this data. You can listen to the full podcast below:

What We Did

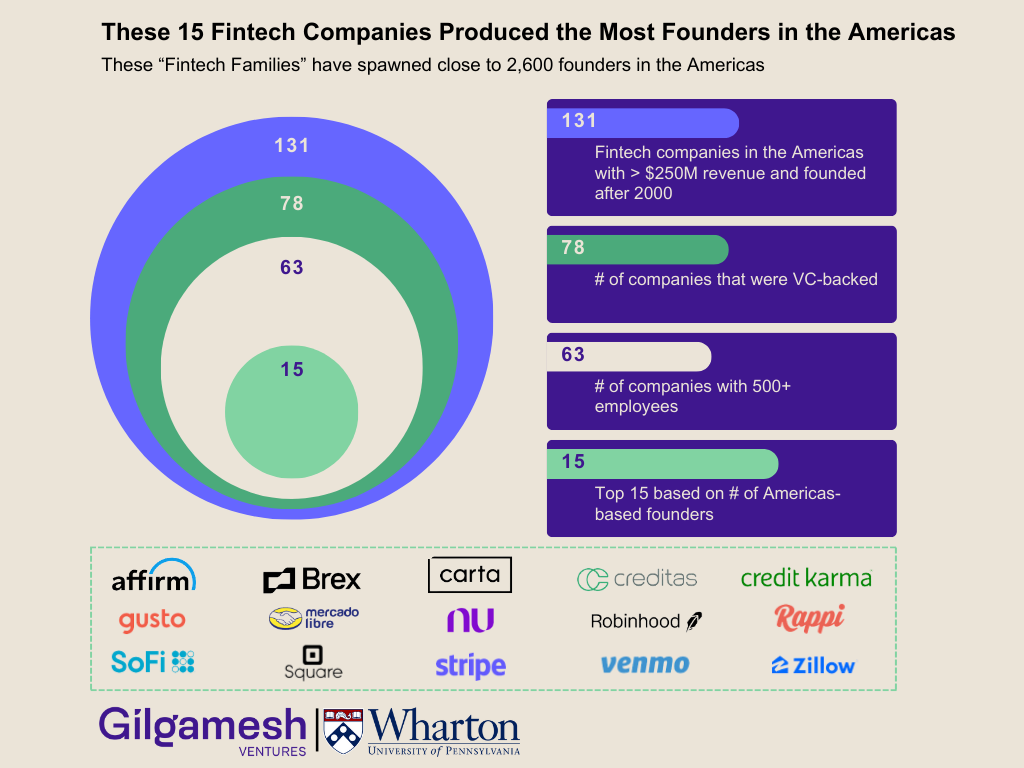

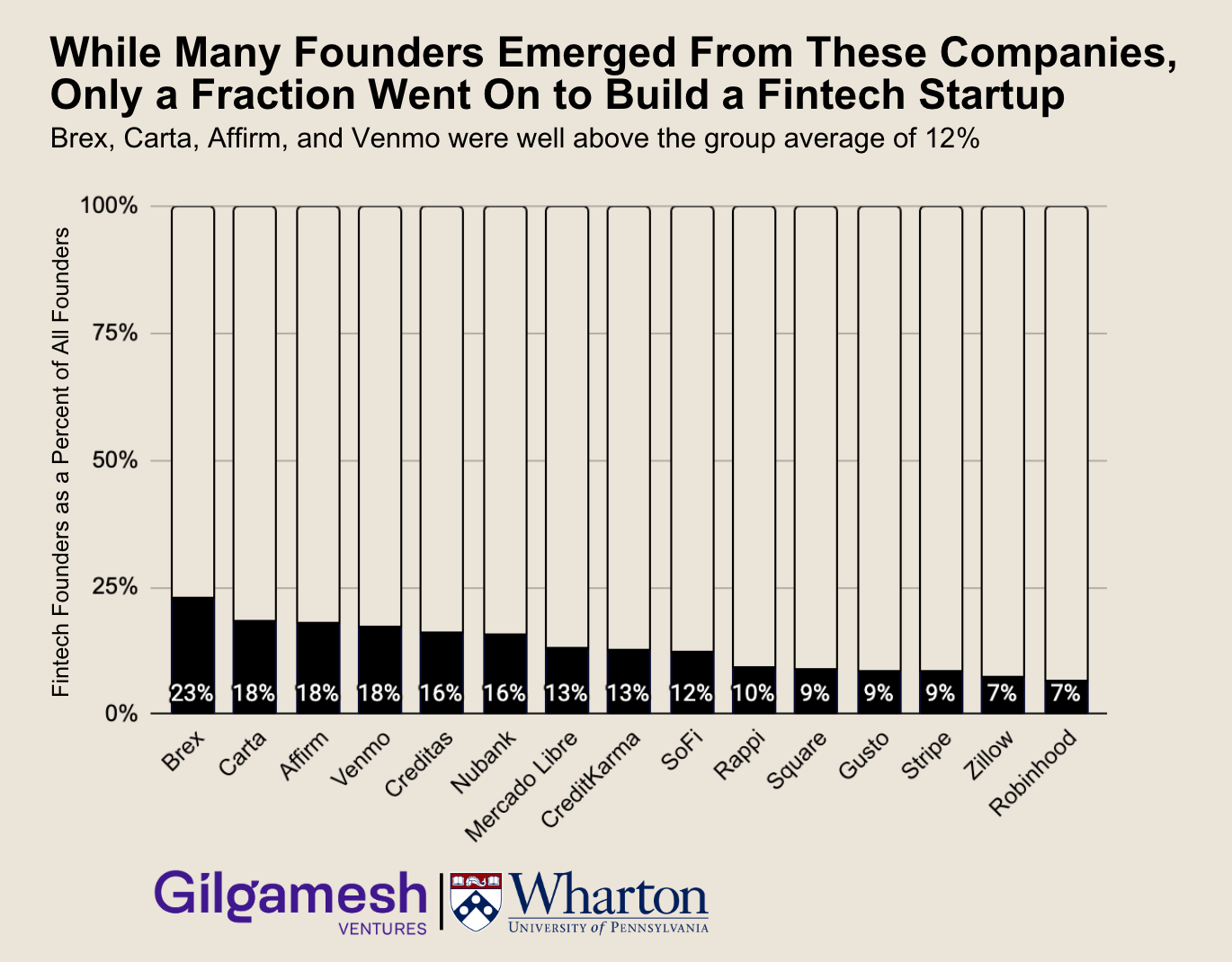

We began by asking the question: What are the most influential companies in fintech? We started with all fintech companies in the United States and Latin America with greater than $250M in revenue that launched after the year 20001. From this list, we honed in on the top fifteen fintech companies with the highest number of former employees who became founders in the Americas. These fifteen companies, which we dub the “Fintech Families,” spawned close to 2,600 founders in total across the Americas, and ~12% (298) of those founders founded fintech companies across the US and Latin America. The Fintech Families have attracted some of the brightest minds in technology and finance, providing them with the experience, networks, and inspiration needed to strike out on their own and create the next wave of groundbreaking fintech startups.

Above all else, our research confirms something we already believed intuitively: that a subset of fintech’s pioneering companies have inspired a wave of fintech founders to start companies of their own. These alumni startups furthermore have very promising early momentum, and this dynamic seems to be accelerating in the last 18 months, with 27% of this subset of founders launching fintech companies in 2023.

While the pace of investment in fintech may have slowed in the last year, our findings underline resilience and what we believe to be growing momentum among these alumni companies. A new wave of fintech startups has emerged from the Fintech Families, with over a third of the top startups in our analysis receiving funding in the last two years alone. In fact, 2023 produced the highest number of fintech founders across any individual year, signaling that entrepreneurs are ready to jump into emerging verticals in the space.

Below are the fifteen Fintech Families we identified, along with some accompanying statistics:

We hope that this information is helpful to anyone thinking about joining a fintech company, studying the landscape, or investing and building in the space.

What have we learned?

PayPal set the standard for Fintech Families, but how did our fifteen fare? Which was the biggest? Who produced the most notable alumni? We explore these below, however, we want to emphasize one obvious point – the Fintech Families have a significant and outsized impact on the fintech universe. To examine their impact, we considered how many alumni companies were created, who created them, what industries they emerged in, and when they occurred. Some of the results were surprising.

Power laws are real, but size isn’t everything.

Our foremost goal was to find the most influential fintech companies – the ones that spawned the greatest number of founders to come after them, and how they stacked up amongst each other. We had a decent idea when we started about names that would probably end up on the list. But we did not know which ones would come out on top – which ones would produce the highest volume of and most impactful entrepreneurs.

In looking at the results below, each of the Fintech Families had an impact, but several went above and beyond in terms of generating future founders in the fintech space. You can see this clearly in the below view of fintech founders by company.

This is interesting enough, but a profound variance emerges when you examine the quantity of funding. Some of these numbers are astonishing. Square alums have raised almost $1b, Zillow founders almost $900m, and SoFi founders almost $600m. These are just the top three.

The implications of this are huge. It makes sense that some have advocated building venture funds that solely invest in alums of certain very successful companies. Of course time will tell how these alumni companies perform in terms of exits and liquidity in the coming years. As investors at Gilgamesh Ventures, this is something we are asking ourselves when examining this data, and of course we’ll be on the lookout for ways to invest in founders from our own best portfolio companies going forward.

Product and engineering leaders disproportionately start alumni companies.

France produces great chefs, and Brazil produces amazing footballers (and lately fintech regulators). It’s no secret that certain teams within certain companies are famous for producing the best in certain fields. We hoped to find similar types of data in our analysis although strong conclusions would require further study. We were not disappointed.

What we found was that the significant talent in product and engineering roles at the Fintech Families indeed went on to make a huge splash in terms of building alumni fintech companies. Fully 50% of the founders that we observed from the Fintech Families had a background in product or engineering, and many went on to become technical founders of the companies they eventually started. This tendency to create companies exceeded the proportion of those organizations in such roles – indeed, fintech’s technical leaders are perhaps truly best in class, from a leadership and vision perspective.

What else can we say about the types of people from Fitnech Families that go on to start companies? Strategy and biz ops are surprisingly common as founder backgrounds, particularly given that such roles occupy relatively low headcount at most fintech companies. Sales perhaps is under represented, given that few from such roles started companies yet are abundant at the companies themselves. Looking forward, we think there is potential for changes in the future in one respect – compliance and legal personnel indeed could become more common founders in the future, as such functions become more widely acknowledged in fintech due to their importance to most business models.

Fintech companies create founders that can lead in other verticals.

Domain expertise is a controversial but important component of all leadership. It’s obviously hard to lead when you are not competent in the subject you are trying to build in. Yet it isn’t everything. Some leaders primarily lead within their sphere of prior expertise, and others thrive most where they know relatively little. Jack Dorsey of Square is a good example of this latter approach.

The data shows that founders from Fintech Families don’t just innovate in fintech. In fact, the vast majority build great things outside of fintech. Entrepreneurial spirit perhaps is somewhat transferrable and contagious, and companies that generate a lot of founders in the aggregate also crank out a lot in fintech too. Yet some have more of a bias towards fintech – Brex, Affirm and Carta being foremost among them. Brex, for example, had 23% of its founders become fintech founders - double the group’s average of 12%. The data below breaks this down by company.

Alumni of Fintech Families launch and raise capital regardless of market conditions.

Raising a ton of money when the world is awash in cash is great – especially for the person doing it. But doing so when the macroeconomic chips are down proves a lot more difficult. We wanted to see whether the alums of the Fintech Families were driven simply by momentum, or whether they were made of a stronger lasting advantage, such that they could build when times were tough.

Accordingly, we looked at when alums from the Fintech Families started companies. As most know, times were good in the late 2010s generally, fantastic in 2020-2021, and the last few years since have been rough. But here, the results really surprised us – Fintech Family alums actually started more companies in 2023 than in the preceding years. 27% of this subset of founders launched fintech companies in 2023 and we certainly did not expect this. The data is below.

But why? We have several theories, but little conclusive data. It is possible that many found the flexibility to start companies later on after they took money off the table while working at big companies in 2020 and 2021. It’s also possible that some started companies following mass layoffs after the market turned in 2022.

But as investors, we hope for other explanations. We really believe that great founders seized the opportunity presented by weakening competition. Bad macroeconomic conditions mean that ambitions decline and competition contracts. And we also like to believe in the fearlessness of many founders. With examples abounding from Paypal to Amazon to Stripe and SoFi, it is our view that fintech thrives most in times of difficulty. The times when supply constricts and customers are underserved represent the best opportunities to build generational companies in our view. Perhaps that time is now!

Families may matter more outside the US, than within it.

As should be obvious, influential fintech companies are not exclusive to the US. Indeed there’s reason to believe that they are more influential internationally. Four of the Fintech Families on our list are from Latin America (Mercado Libre, Nubank, Rappi, and Creditas). Based on our analysis, we can conclude that Fintech Families are indeed more influential in LATAM than in the US. We can see this, for instance, by comparing the amount of capital raised by the top-4 families in each market, compared to the total capital raised in those markets.

More differences exist too. We observe there is some clustering regarding the type of business models among those that made the cut for the fifteen. Marketplaces (Mercado Libre and Rappi) and lending (Creditas and Nubank) are the only two categories present in Latin America in our analysis, whereas the US has more diversity of sub-verticals (e.g., payments, investing, proptech), but early indications show that greater diversity of business models is on its way, based on our review of the alums of these companies. We believe the future will bring greater balance to the mix from LATAM.

Brazil is the largest economy in Latin America, so we expected some bias in the data towards the influence of Brazilian / Portuguese-speaking companies among our Fintech Families. Despite there being an even representation between Brazilian and non-Brazilian Latin American companies among our 15, the number of founders coming from the non-Brazilian companies far outweighed those coming from the Brazilian companies. We were surprised to find that Mercado Libre and Rappi (the two Latin American, non-Brazilian companies among our Fintech Families), spawned nearly 3x the number of founders and 2x the number of fintech founders as Nubank and Creditas (our two Brazilian companies among our Fintech Families).

What else?

We will see the biggest effects of these Fintech Families in the next 5-10 years.

All of the above is interesting, but of course, like you, we are most interested in what is going to happen next. A few things are certain to follow. Foremost among those is the idea that we’re in the early innings of impact from the alums of the Fintech Families. The largest cohort of new companies being created among alums of the Fintech Families was 2023 – last year. If past is prologue, we can probably expect a continuation of companies being founded from these sources in the coming years.

But more importantly, we can expect these companies to have their greatest impact in the next decade to come. The median incubation time for companies to IPO falls between seven and ten years, so the 2023 cohort will likely be reaching liquidity from 2030 to 2033. That’s a long time from now. And perhaps these companies will then go on to spawn their own alumni networks, or perhaps they won’t. Regardless, we feel confident that we are going to hear more from the alums of these companies in the coming years.

Who and what create Startup Mafias and where will we likely see them next?

Figuring out the types of founders that create Fintech Families is a huge undertaking – a massive subject on its own that’s probably outside the scope of this analysis. To answer that, one must answer the question of who creates great companies – opinions on the matter span far and wide, and we don’t claim to have a special edge in articulating those values here today.

But we do notice some interesting things about the companies that we’ve identified above, along with other examples from the past like PayPal. If we look at these companies in the aggregate, they all do different things, and they are from different geographies. But across the board, these companies have managed to all build nationally and sometimes internationally recognizable brands. This is a significant common thread – it is evident that strong brands are a magnet for strong talent. Or it’s possible that the causation runs the other direction: Perhaps strong talent is necessary to create strong brands. It is hard to say which is driving which, but the relationship is extraordinarily obvious, looking at the data.

To create a Fintech Family, you need to attract amazing people. Said differently, companies that fly under-the-radar, that focus solely on head-down-execution, may fail to capture the attention of amazing talent, with the potential to found and lead companies down the road.

We also asked ourselves where we’ll see Fintech Families emerge next. Of course, we can expect that big winners generally are going to be the main source. And predicting who those will be is just as hard as saying what types of founders create Fintech Families – if we knew that, we’d be really rich!

But we have some opinions and not only because we are active investors in the category. Although we expect to see our share of “big trends” that sweep the fintech landscape in the coming years, we also believe that a few other things are certain. First, we believe that fintech insiders will be over-represented among the winners in the future. Yes, sometimes outsiders can bring a fresh perspective and build something big, but people that understand their space are better suited than ever to win in the increasingly complex regulatory and technological climate that we inhabit today. Domain expertise, which we touched on above, really matters in fintech, and that only becomes more the case when regulators are involved, which they increasingly are.

Second, we greatly value and recognize the importance of forging relationships with key talent at successful startups early. It is not a coincidence that many of today’s top fintech founders started their careers at other successful fintech startups - in fact in many cases investors view it as a prerequisite before writing a check. It is our job to identify and stay close to key talent so the trust and relationship is already built when they choose to start their own companies. As early stage investors it is crucial we are constantly looking to meet the top performers who have founder qualities.

In conclusion, we had a lot of fun diving into the data and identifying key trends. In some cases, it confirmed what we already knew, and in other cases, it proved us totally wrong. And in some cases it brought to light certain information that hadn’t even been on our radar. Hopefully this deep analysis helps you as much as it has helped us better understand our growing and complex industry.

Gilgamesh Ventures Team - Miguel Armaza, Andrew Endicott, Paula You

Wharton School Team - Dave Erickson (Professor), Kirstie Irmana, Kris Jenk, Josh Jagota

About Gilgamesh Ventures

Gilgamesh Ventures is a NYC-based, early-stage venture capital firm that backs founders building fintech companies in the US and Latin America. We invest in pre-seed and seed companies, across payments, SaaS, infrastructure, compliance, anti-fraud, lending, office of the CFO, insurtech, proptech, and other verticals within financial services. Learn more at gilgameshvc.com or follow us on LinkedIn and Twitter.

About The Wharton School

Founded in 1881 as the world’s first collegiate business school, the Wharton School of the University of Pennsylvania is shaping the future of business by incubating ideas, driving insights, and creating leaders who change the world. With a faculty of more than 235 renowned professors, Wharton has 5,000 undergraduate, MBA, executive MBA, and doctoral students. Each year 100,000 professionals from around the world advance their careers through Wharton Executive Education’s individual, company-customized, and online programs, and thousands of pre-collegiate students explore business concepts through Wharton’s Global Youth Program. More than 105,000 Wharton alumni form a powerful global network of leaders who transform business every day. For more information, visit www.wharton.upenn.edu.

Except for Mercado Libre, founded in August 1999

Share this post