This article is part of Fintech Leaders, a newsletter with 75,000+ builders, entrepreneurs, investors, regulators, and students of financial services. I invite you to share and sign up. If you enjoy this conversation, please consider leaving a review on Apple, Spotify, or Youtube.

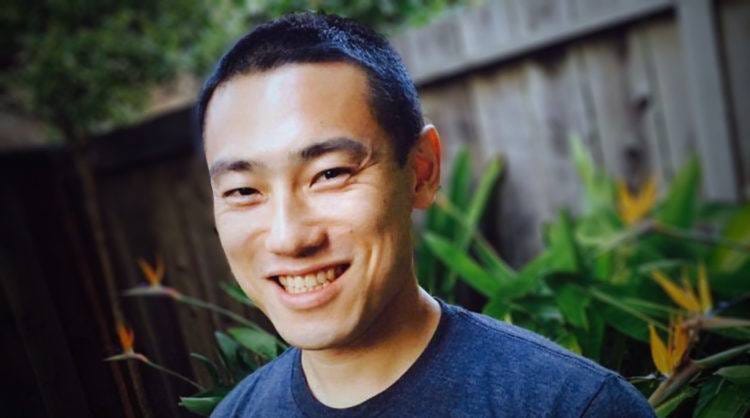

I stopped by the New York Stock Exchange (NYSE) to interview Yoshi Yokokawa, CEO & Co-founder of Alpaca, an API-first brokerage infrastructure company that has raised over $100 million to serve more than 200 financial institutions across 40 countries, with 5 million brokerage accounts on their platform.

Our conversation took place in the NYSE's podcast studio, a great backdrop to talk about infrastructure that's connecting global investors to US markets. Yoshi had flown in from Kyoto the night before, and despite the jetlag, his energy was high and his passion was palpable. Special thanks to our friends at NYSE for hosting us!

In this episode, we discuss:

Balancing data-driven decisions with entrepreneurial instinct

"I think gut is actually the output of data, in my opinion, but in a very unconscious way"

Yoshi views entrepreneurial intuition not as something innate or mystical, but as unconscious data processing, which only gets stronger and more finetuned with experience. Yoshi believes the best decisions balance quantitative analysis with experience-driven instinct, which might explain why he personally maintains two investing approaches: methodical value investing through dollar-cost averaging alongside aggressive high-leverage crypto and levered trading.

When it comes to management frameworks, while Yoshi has implemented decision-making constructs at Alpaca, he is also concerned that excessive formalization can actually lead to constraints that limit entrepreneurial creativity. And as AI advances, strictly rule-based decision-making could make traditional management roles obsolete, which is why the most valuable leadership quality, he argues, will remain one’s ability to synthesize massive amounts of information and act decisively in uncertain conditions - something no framework can fully capture.

Why Alpaca's self-clearing model slashes dependencies, cuts costs, and accelerates innovation

“Most existing clearing firms use vendor software, which means everything you do transactionally gets costed by outside vendors. If you want to change certain things, you have to ask them to change it by the waterfall system, so you don't know when it'll be over."

In the financial infrastructure business, two critical components determine competitive advantage: regulatory stack and tech ownership. Alpaca recently embarked on the strategic decision to become a self-clearing broker-dealer. Not just to improve margins, but to fundamentally streamline their development velocity and service capabilities. Alpaca even built direct connectivity to the Depository Trust & Clearing Corporation (DTCC), the backbone of US securities markets.

This vertical integration has eliminated dependencies on legacy systems from vendors like Broadridge or FIS, which Yoshi describes as waterfall processes that slow innovation and provide no differentiation. As traditional finance and crypto continue converging, taking control of their own stack has enabled Alpaca to support clients who want to offer multiple asset classes through a single API.

Why API-first companies need a sandwich approach: bottom-up developer community and top-down enterprise sales

Alpaca's go-to-market approach follows what Yoshi calls the "API sandwich", a three-pronged strategy that builds community support, secures mid-market adoption, and lands enterprise deals simultaneously. The foundation is their developer community, who serve as evangelists and provide authentic validation for the product. These developers often become entrepreneurs or influence purchasing decisions at their next (and often larger) companies, creating a natural growth flywheel.

While traditional enterprise sales cycles can be agonizingly long, especially in financial services, API-first companies can demonstrate immediate value through a bottom-up approach. This creates a powerful momentum that complements top-down selling efforts. Yoshi is a big fan of this hybrid approach and says it has been essential for Alpaca's rapid expansion across 40 countries, enabling them to serve both startups and established financial institutions worldwide.

Why Japan's economic history shaped a generation of domestic entrepreneurs while global founders like Yoshi remain the exception… and lots more!

“I think this trend of global access to capital markets in general in a more borderless way will continue. So right now, just thinking about US equities, 18% of the investment comes from outside the US. I think this will continue to increase. And I also think that the US, Wall Street, including NYSE, will continue to be the center of the global companies to try to be listed in the future."

Japan's entrepreneurial world is a fascinating enigma for most outsiders. In the aftermath of WWII through the 1980s, the country produced world-conquering companies like Sony, Toyota, Nintendo, and Honda, whose founders looked beyond Japan's borders for growth. But once the bubble popped and the economy collapsed in the 1990s, most of the entrepreneurs that followed have had a distinctly inward focus.

When Japan became an expensive, self-sufficient market during the bubble era, businesses no longer needed international customers to thrive. This created entrepreneurs who never developed the global mindset or language skills necessary for expansion. There's obviously been some exceptions like Softbank's Masa (where Yoshi worked as a teenager packaging CD-ROMs), but as a Japanese founder building a global company, Yoshi admits he feels a bit lonely in Kyoto these days—connecting more with westerners than with fellow tech entrepreneurs.

Want more podcast episodes? Join me and follow Fintech Leaders today on Apple, Spotify, or your favorite podcast app for weekly conversations with today’s global leaders that will dominate the 21st century in fintech, business, and beyond.

Share this post