This article is part of Fintech Leaders, a newsletter with almost 30,000 dreamers, entrepreneurs, investors, and students of financial services. I invite you to share and sign up here!

In this Fintech Leaders episode, I sit down with Brynne McNulty Rojas, Co-Founder and CEO of Habi, a PropTech company revolutionizing the real estate market in Latin America and streamlining the traditionally opaque home buying process in the region.

Founded in 2019, Habi has raised over $100 million from investors, including SoftBank, Inspired Capital, Tiger Global, Homebrew, Clocktower, 8VC, and many more.

Brynne and I explore:

Building Habi and a deep dive of the exciting PropTech revolution taking place in Latin America.

“You look at Colombia or Mexico - the pain points are astronomically higher in every aspect of the concept of buying, selling, renting, owning, financing, insuring, etc. And there's just so much more to be done… this just means there is a bigger problem to be solved and potentially much more ability to build out a one-stop, full-service solution.”

And we’re talking about a trillion-dollar residential market in Colombia and Mexico alone!

“Just to give you a sense of the magnitude - in Colombia, the market value of homes is $240 billion. in Mexico, $830 billion, Those are incredibly large markets, especially coming from Colombia, where people think, ‘Oh, you're not in Brazil or Mexico, you're too small of a market’ - we could have built and scaled a multi-billion dollar business in Colombia alone.”

Their recruiting approach to attract those crucial first employees, developing Habi’s culture, and a rundown of the company’s four key values and why they were written in English, rather than Spanish.

Habi Value #1: I’m a window open and transparent

“It’s really pushing this idea of honesty, true feedback, never manipulating information. Whether it's internal or external stakeholders, not falling into a culture that so much respect that you would push back up or down.”

Habi Value #2: I’m the customer’s home

“At the end of the day, we are dealing with the most significant financial decisions in people's lives. We never want anyone to feel that what we are doing is anything but the best for them.”

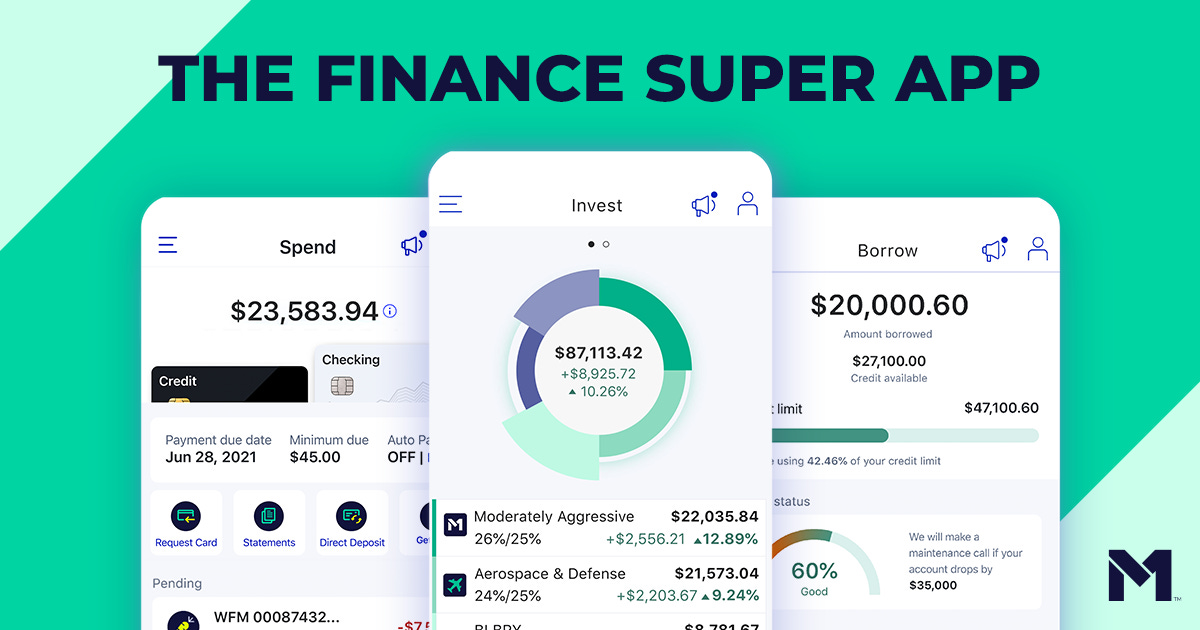

M1 Finance is the Finance Super App that puts you in control of your wealth. Invest, borrow, and spend your money how you want with sophisticated, automated tools to help you reach your financial goals more easily. Investing in securities involves risks, including the risk of loss. Borrowing on margin can add to these risks. M1 Finance LLC, Member FINRA/SIPC. Click here to get started.

Habi Value #3: I’m a master key

“This is really about empowerment and giving tools to everyone throughout the organization to solve problems. People shouldn't be waiting for instructions. We want proactive leaders, no matter how long they've been at the firm or how senior they are, to be building towards something that we know is our common goal.”

Habi Value #4: I’m the bell but we make the sound

“In our offices, we actually have a big cowbell that the sales team rings when a transaction is signed. The concept behind that, as I'm sure you can imagine, is while that individual salesperson who signs the kind of paperwork with the client is the one who rings the bell, the entire team is behind that.”

Habi’s secret data analytics machine and how they’ve scaled to perform over 30k real estate pricings per month.

“Data is the foundation of Habi… we understand market prices really well… and understand what's happening in the market. We make over 30,000 pricings a month and the vast majority of the home offers that we make are actually made automatically.”

Fundraising lessons for entrepreneurs… and a lot more!

Want more podcast episodes? Join me and follow Fintech Leaders today on Apple, Spotify, or your favorite podcast app for weekly conversations with today’s global leaders that will dominate the 21st century in fintech, business, and beyond.

Emerging Fintech Leaders

Three early-stage fintech companies doing amazing things

Odo takes the anxiety out of investing in your future. Its investment accounts are FDIC-insured, yet powered by the index funds on the US stock market. With Odo, investors have it both ways: loss-protected, decision-free investing. The platform is now in beta testing and primed to make a large indent in the lack of access to investment services for the average American.

Co-Founders: Porter Bayne, Shauna Armitage, and Jan Drake

Uploan’s goal is to improve employee financial wellness throughout the Philippines by providing salary-based loans, advances, and insurance products. Attached to their services comes a program for financial education that truly engages employees to play an active role in their financial lives. Innovative workforce benefits are key to attracting and retaining talent, thus alternative lending products like Uploan’s will be core to the future of work. And, they’re hiring!

Co-Founders: Benoit Portoleau-Balloy and Liam Grealish

Fresh off of raising $100 million in Pakistan’s largest ever seed round, Tag has made a name for itself as a leading innovator in South Asian banking services. Tag’s solution leverages the B2C channel, working with firms of all sizes to offer their employees banking and other financial services. Employees can obtain a VISA debit card, pay monthly bills, send money to peers, and receive their salaries through their Tag account, which takes only a few minutes to set up.

Founder: Talal Gondal

Want to break onto the fintech scene with a feature in our newsletter? Introduce us to your startup here!

-Thank you for reading!

Miguel Armaza is Co-Founder & Managing General Partner of Gilgamesh Ventures, a seed-stage investment fund focused on fintech in the Americas. He also hosts and writes the Fintech Leaders podcast and newsletter.

Share this post