This article is part of Fintech Leaders, a newsletter with over 30,000 dreamers, entrepreneurs, investors, and students of financial services. I invite you to share and sign up here!

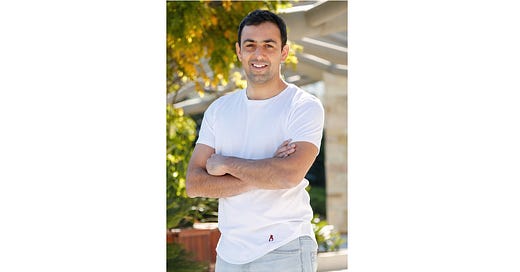

In this Fintech Leaders edition, I sit down with Gaston Irigoyen, CEO & Co-Founder of Pomelo, a company building and modernizing the fintech infrastructure of Latin America.

Since inception, Pomelo has raised over $45 million from an impressive roster of backers including Tiger Global, Monashees, Sequoia, Insight Partners, Index Ventures, QED Investors, and Gilgamesh Ventures. As well Jackie Reses, Max Levchin, Biz Stone, Angela Strange, Eric Glyman, and other impressive angels.

We discuss:

Fundraising lessons – is it an art or a science? Gaston shares frameworks and best practices that have worked for him throughout his entrepreneurial journey and why it’s critical to also bring strategic angels and industry operators onboard.

“Is it an art? Is it a science? I think it's a little bit of both. Nowadays, you can run the process in a very scientific manner, with a very scientific sort of fashion and approach… But I also feel there's a lot of art into it, right? You need to be paying attention to all the small signals throughout those processes… and have that sort of ability to read the situation and to make quick sort of adjustments.”

“When you're talking to funds or even angel investors, you’re talking to people, right? You're not talking to machines. So that sort of empathy, that sort of approach, having an etiquette and being able to build trust and confidence, these are all very, very important things.”

Modernizing LatAm’s financial infrastructure and how Pomelo is refreshing legacy tech that was built decades ago.

“We are essentially trying to create the first 21st century regional infrastructure company, so that you can not only launch a fintech with ease, but you can also scale it very quickly throughout the region.”

Gaston’s optimism for the next decade of entrepreneurship in the region and why the next wave of fintech will probably be led by B2B companies.

“Latin America continues to be in a very good track when it comes to attracting capital from other parts around the world... The ingredient that is going to start to play a very positive and important role, starting in 2022, is that as we see the Nubank IPO, the dlocal IPO, and a few other IPOs, all these angel investors that are going to profit will start pouring more and more of their capital into the region… and I think that's going to be critically important.”

Reflections for emerging markets entrepreneurs and what he learned from living in Dublin, Ireland… plus a lot more!

"I'm pretty convinced that for us, in Latin America, or for entrepreneurs in emerging markets, for that matter. Now that we can tap global capital, one of the very first things that we need to do is we need to build that trust. We need to be able to close that gap of what an investor may think of an emerging markets entrepreneur, when compared to what they're used to in their home market."

Hope you enjoy my conversation with Gaston Irigoyen of Pomelo.

Want more podcast episodes? Join me and follow Fintech Leaders today on Apple, Spotify, or your favorite podcast app for weekly conversations with today’s global leaders that will dominate the 21st century in fintech, business, and beyond.

Emerging Fintech Leaders

Want to break onto the fintech scene with a feature in our newsletter? Introduce us to your startup! You can also find the full list of featured companies here.

Three early-stage fintech companies doing amazing things

With Mexico’s Nufi, any company can become a fintech. Through their easy-to-use APIs (building blocks), the company provides the technological infrastructure that allows businesses to create fast, flexible financial products with regulatory compliance. Nufi currently offers plug-and-play APIs for KYC, identity validation, background checks, and more!

💰Funding Status: Nufi is a recent alum of the Western Union/Techstars Fintech Accelerator and is currently raising on AngelList.

👥 Founder: Hans Villa (LinkedIn) and Ilich Núñez (LinkedIn)

What if you could reduce your student loan debt by posting on social media? Emerging brands and companies are partnering with Dallas-based College Cash to run content campaigns through on-campus influencers, but their compensation goes directly towards paying down student debt. Beyond paid promotions, gig economy workers can also use the College Cash API to channel their tips toward reducing debt. In this way, companies can grow while making a positive impact on their employee’s financial lives, and college students can get ahead on debt by continuing everyday behaviors. Read more here.

💰Funding Status: College Cash was recently named a member of the FinHealth Accelerator’s 2022 Cohort. The company is currently backed by investors such as Gaingels and Overlooked Ventures and looking to complete its seed round.

👥 Co-Founders: Demetrius Curry and Michael Simpson

💪🏽 CHALLENGER (@IncChallenger on Twitter)

Americans are facing a savings crisis, and Challenger believes employers stand to benefit from addressing it in their benefits packages. The mission-driven Colorado fintech powers employer-sponsored financial products for America’s workforce, starting with emergency savings. With Challenger, employers see better retention while employees see better financial health. Beyond this, both parties are better protected from the risk of an unexpected financial burden derailing an employee’s career path.

💰Funding Status: Challenger is a alum of Western Union/Techstars Fintech Accelerator, as well as a member of the FinHealth Accelerator’s 2022 Cohort. Most recently, Challenger received a $226,000 grant from the State of Colorado to help employers fund Emergency Savings Accounts for Coloradans as a benefit beside their 401k. Additional backers include Hustle Fund, Upscale, Outbound Capital, 1517 Fund, and Purpose Built Ventures.

👥 Co-Founders: Nate Gruendemann (LinkedIn / Twitter), David Kircos (LinkedIn / Twitter), and Gabe Rapoport (LinkedIn)

Want to break onto the fintech scene with a feature in our newsletter? Introduce us to your startup! You can also find the full list of featured companies here.

-Thank you for reading!

Previous Episodes You May Enjoy:

Miguel Armaza is Co-Founder & Managing General Partner of Gilgamesh Ventures, a seed-stage investment fund focused on fintech in the Americas. He also hosts and writes the Fintech Leaders podcast and newsletter.

Share this post