Former Vanguard CEO & Chairman Bill McNabb: The Future of Finance, Leading in Crisis, & ESG

This article is part of Fintech Leaders, a newsletter with over 19,500 dreamers, entrepreneurs, investors, and students of financial services. I invite you to share and sign up here: Substack

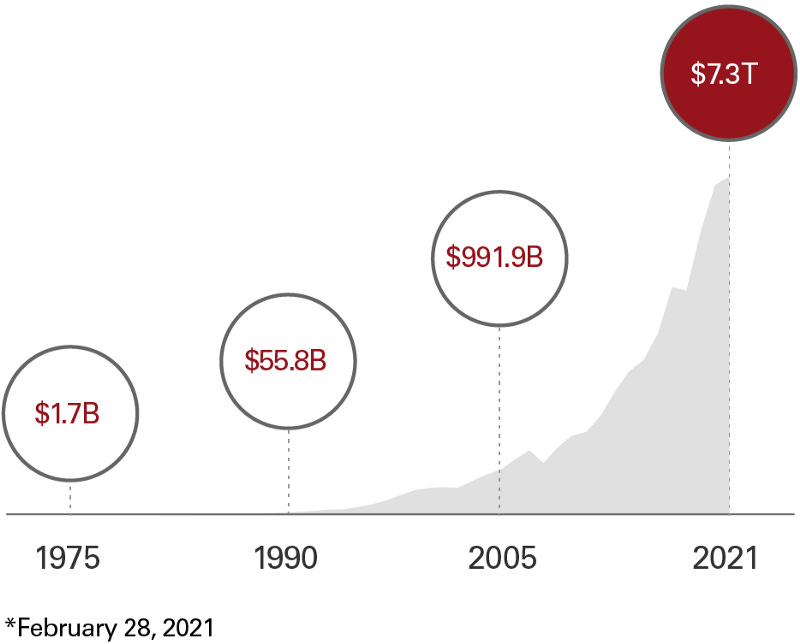

My good friend, Ryan Zauk, sits down with Bill McNabb, former Chairman & CEO of Vanguard, one of the world’s largest and most important financial institutions with over $7 Trillion AUM.

A Wharton MBA alum, Bill joined Vanguard in 1986 and became CEO in 2008 and Chairman of the Board of Directors / Board of Trustees in 2010. He stepped down as CEO at the end of 2017 and as Chairman at the end of 2018. Bill serves on the boards of IBM, United Healthcare, and Axiom, as well as rising fintech startup Altruist. He also serves as Chairman of EY’s Independent Audit Committee.

In this powerful conversation, Ryan and Bill cover a broad range of topics, from ESG and tokenization to crisis leadership from American POWs. Let’s break it down below:

Teaching Latin -> Wharton MBA -> Vanguard CEO

How many CEOs started their careers as classics teachers? After rowing at Dartmouth, Bill headed to The Haverford School in Philadelphia, teaching Latin while coaching multiple sports.

“I think the real reason I was hired was not that I was a classics major, but that I could coach three sports and was relatively inexpensive.”

He eventually found his way to Wharton, joining JP Morgan after graduation working on the LBO-style deals and financial engineering. He later got a call from an old Wharton connection, telling him he should apply to this role at some small company called Vanguard working on annuities. He sat down with legendary founder Jack Bogle, and as he says “one thing that really jumped out about Vanguard was the sort of purpose-driven organization it was and Jack really hammered the fundamental values. So I took a flyer.”

He then started a 20+ year journey to CEO, working on a number of high-growth departments, company-defining products, and the shift to the web:

“I got to be very involved in the pivot to a technologically oriented strategy. We were very early to see the potential of the web, and to Jack Brennan’s (predecessor CEO) great credit, he basically turned us loose and said come to me with ideas; the budget is there if you can make your case. We pretty quickly developed Vanguard.com and it ultimately became the way we do everything today. We never had a physical presence, we were virtual, but virtual in the early days was post office box and telephone!”

Crisis Leadership Lessons from American Prisoners of War, Jack Bogle, & Jack Brennan

“If you get complacent, you eventually become irrelevant.”

One of the most powerful pieces of the episode is Bill’s deep dive into leadership lessons, especially during his time as CEO during the Financial Crisis. It starts at about 13:20 and I highly suggest you tune in. (Apple | Spotify | Soundcloud)

Bill became CEO just before Lehman Monday, and had to quickly learn how to lead a global organization in the darkest hours of finance.

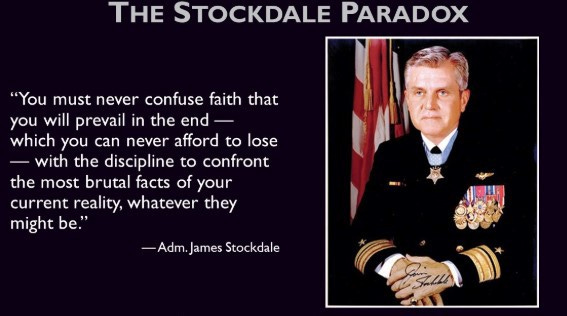

He explains how he used the Stockdale Paradox as his guiding light, and how this powerful framework helped Vanguard thrive:

“You’ve got to execute like crazy every day during a crisis. And speed is important….You have to create frameworks so that you can make decisions rapidly…But at the same time, once you sort of begin to go, okay, we will get through this, you have to begin to paint that picture of what the other side’s going to look like. And how are you going to be positioned for that.

So we’re meeting three times a day, on one hand to just make sure operationally, everything was going the way it should. And at the same time, we began to dream about what could we look like on the back end of this thing, what would be different regulatory wise, competitive, wise, demographically, all those things, and then we were able to create a strategy around that.”

The results?

“Going into [the crisis] we were at about $1T AUM and a decade later we were at $5T+ AUM, that number is now well over $6T. And half of that is reflective of businesses, products, or services that we started DURING the crisis (ETFs, global expansion). Those decisions that we made during the crisis ended up defining half of the company!”

He cites how proud he is of the current Vanguard leadership team as well as IBM’s, who both took aggressive approaches during the COVID crisis. Vanguard launched a private equity offer during COVID with HarbourVest, tapped Infosys to run recordkeeping and administration for their defined contribution plans, and named two new members of the senior team to position themselves for a more digital future. All while keeping buildings sanitized and secure, figuring out all of the work from home setups, figuring out customer support lines, and more.

IBM announced a new CEO in April 2020 and in October stated they will split the company in two.

Vanguard’s Positioning During the Rise of Robos

Bill goes into great detail about how Vanguard has responded to Fintech over the years, including Vanguard’s own massive $200B Robo offering they built this decade (Betterment & Wealthfront combined have way less than half of that). One highlight is how Bill got introduced to Wealthfront very early on, and his admiration for the disruption fintech brought to his space:

“The great thing about what Wealthfront and Betterment did is they redefined what could be done at a price point that nobody believed possible.”

He continues:

“Two years after Wealthfront was started, we met with the founders, and we brought in a venture capitalist to talk to our board about what was happening. He basically predicted that companies like Vanguard would go out of business if they didn’t figure out this space more clearly. I don’t think that was quite true, but it was a real wake up to his credit…

They came at it with a real blank sheet of paper…they hired the best software engineers on the planet…And then they hired former Vanguard board members…when I first looked at, I’m like, this is pretty cool. And, of course, I loved the fact that it recommended a lot of Vanguard ETFs!”

The Future of Wealth Management

Bill laments the latest Robinhood and Gamestop craze, especially the lack of transparency around Payment for Order Flow (which, as he points out, isn’t completely evil). How will the day trading frenzy impact the future of wealth management?

“Advice, and people needing more help, is going to be a long-term trend. It feels like we’ve taken a step back with everybody out there trading away. I guarantee you when there’s a 20%, market correction, all of a sudden, there’s going to be a rethinking.

At Vanguard, we have invested just massive amounts of money in getting advice right and in lots of different flavors. You’ve got this hybrid model that I talked about, which is digital-only at the core, that’s rolling out all around the world, and getting great receptivity in markets that you would not expect it to…There will be huge evolutions, not revolutions, around how thatadvice gets delivered, and what you’re doing to complement it from a service standpoint…You’re gonna see a whole continued evolution slash revolution in advice. I think we’re at Robo 1.5, we need to get to 3.0. And I think that’s coming.”

He specifically calls out artificial intelligence and an even more digitally-powered advisor as specific pieces that will grow this decade.

Tokenization, & the Future of the BlockchainAnother trend Bill is extremely bullish on: blockchain technology and tokenization of assets. He believes investors will ultimately be the winners:

“As an investor, wouldn’t it be great to diversify further from traditional stocks, and bonds and cash into infrastructure, but in a way that doesn’t completely kill you from a liquidity standpoint?..If the source of return and pattern of return is different than that of more traditional asset classes…that’s a win. So I think tokenization is going to happen, and it’s going to happen big time. And you’ll see this great convergence of private markets and public markets continue.

The Double-Edged Sword of ESG & the Importance of Transparency

The last trend Bill mentions is the continued rise of ESG, and the customizations and flavors it will come in. Bill is excited about products that empower people to customize investments not just by asset class, sector, or strategy, but by many different ESG criteria. He is less excited about traditional exclusionary ESG (no fossil fuels, alcohol, guns) that have not been shown to outperform the market, but inclusionary ESG:

“What’s really interesting to me on ESG is where people are actually flipping the question around saying, who are the best actors around these things? Who’s got great governance, who’s actually doing things from a social impact standpoint that make them a better business? Who’s managing climate risk in a way that gives them a competitive advantage?

You’re now seeing what I call inclusive strategies where people are actually looking at ESG dimensions as a source of long term performance. I’m really intrigued by that!”

The Fintech Startup Altruist

Bill joined the board of Altruist, a financial advisor technology platform that has the support of investors like Venrock. As Bill describes:

“70% of the wealth market flows through financial advisors…one of the things Altruist is trying to do is build a platform for those advisors, that’s more efficient, more transparent, and frankly, lower cost, so that they can pass more value back to their end clients…

…what appealed to me was looking at a problem and basically saying, How can we disrupt a market that has massive incumbents, but do it in a way that is not disruption for the sake of disruption, but disruption to benefit the end consumer?”

We cover a whole lot more including his frustrations with his day-trading mother, his thoughts on Public.com’s tipping model, a rapid-fire round, and more.

Bill was one of Ryan’s favorite interviews of his career at Wharton Fintech — Enjoy the show!

—

Previous Episodes You May Enjoy:

Y Combinator's Michael Seibel & Dalton Caldwell - Lessons from 5000 Entrepreneurs

Noah Kerner, CEO of Acorns - Leveling the Investment Playing Field

Robinhood’s COO, Gretchen Howard – Democratizing Finance, Navigating a Crisis, & Embracing Change

ARK Invest’s Fintech Analyst Max Friedrich — His Square Thesis, US SuperApps, and Big Ideas!

Mayor Francis Suarez - Bringing Silicon Valley to Miami!

Upstart CEO Dave Girouard — Revolutionizing Lending & Taking a Fintech Public!

Atom Finance Founder Eric Shoykhet — Building For the Retail Investor and Debating PFOF

Redesigning the Asset Management Experience – Brian Barnes, Founder & CEO of M1 Finance

Milind Mehere, YieldStreet Founder/CEO - Transforming Digital Wealth Management

11:FS Co-Founder Simon Taylor — NFTs, Clubhouse, & The State of Crypto

—

Ryan Zauk is an MBA Candidate at The Wharton School, where he runs the Wharton FinTech Podcast. He currently works with the US International Development Finance Corp looking at technology impact investments in developing markets. He has a passion for music, media, and all things FinTech.

You can reach him at rzauk@wharton.upenn.edu or on Twitter.

—

Miguel Armaza is Co-Host of the Wharton Fintech Podcast and Co-Founder of Gilgamesh Ventures, a seed-stage investment fund focused on fintech in the Americas.