Billionaire Investor, Activist, & Educator Tim Draper — China, Bitcoin, and Free Societies

This article is part of Fintech Leaders, a newsletter with over 23,000 dreamers, entrepreneurs, investors, and students of financial services. I invite you to share and sign up here: Substack

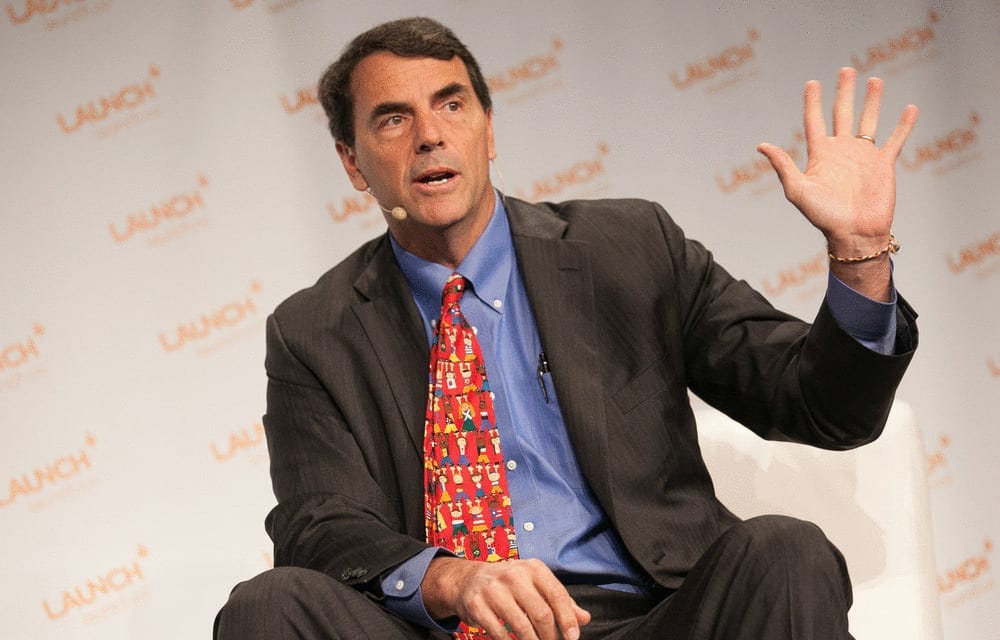

In today’s episode, my good friend and co-host, Ryan Zauk, sits down with legendary venture capitalist, billionaire, bitcoin investor, activist, and educator, Tim Draper.

Tim Draper helps entrepreneurs drive their visions through funding, education, media, and government reform.

Listen on Apple | Spotify | Soundcloud

His investments over the last few decades include companies like Baidu, Hotmail, Skype, Tesla, SpaceX, Robinhood, Twitter, Carta, Coinbase, and many more. He also is a large holder of bitcoin, having bought 50,000+ bitcoins when it was priced below $1,000.

“People have asked me Well, when are you going to sell your Bitcoin? I look at them and I say, into what? Why would I ever sell the currency of the future for the currency of the past? That would be like saying, I’m going to take dollars and turn them into Confederate Dollars, or are going to take Euros and turn them into French francs. You don’t want to do that!”

You can learn more about how to engage with Tim’s various platforms at his website. He also recently released a book titled “How To Be The Startup Hero,” a guide for entrepreneurs.

In today’s episode, we discuss a multitude of topics (one of which Ryan would like to push back on after listening back to the episode):

Why the Mt Gox hack improved his confidence in Bitcoin

“Then Mt Gox happened…And I thought too bad, that was really an exciting experiment. That must be the end of Bitcoin. And what happened was Bitcoin only dropped about 15% in value that day!…And I thought, hmm, some people really need this…so I really dug in and I started studying how Bitcoin was being used. And they were using it for remittance, they were using it for micropayments, they were using it for so many different things...And the unbanked, they all wanted it…So I realized that bitcoin was going to be a big deal.”

China vs. US

“We backed Baidu. But I also met Jack Ma, so I missed that one. And I met Tony Ma, so I missed that one too! So I missed two out of the three…but once we did Baidu, and they went public, all of my venture capital friends came flooding into China. And it was great for everybody for a long period of time. And then they got a dictator-type ruler…it’s government control. And when you go government control, your economy can ride the capitalistic system for a while, and then it goes flatline. So I suspect they’re gonna have 10 really good years, and then they’re gonna go flatline.”

Why small government capitalism is the best government for societal progression

“Many of these have dictators just wait until somebody builds something, then they say, I’m taking that. And if that happens, then there’s no trust in the system. So there’s no incentive to build anything of value. The same thing happens in Argentina, Venezuela, and Nigeria now because they have currencies that just drop 70% in a year. And if it drops 70% in a year, you think, well, I can build something of value, but I’m going to lose 70%! Why would I do this?”

Ryan’s thoughts here: I wish I had fired back on a few quotes in this entire section of the episode. I wanted to challenge some of his assertions on Africa — I had to stay cognizant of time and his answers provided a lot of different themes to continue on. There are many countries on the continent that do not have good governance in place, but certain countries (especially Nigeria!) have birthed amazing, amazing entrepreneurs and success stories.

Bitcoin & virtual life finally challenging governments

“If a government is doing a bad job, or printing extra money, or absconding with money, it’s not trustworthy! Anybody who runs their business in bitcoin will win over time. Governments have to fight for us now, they have to compete for us, they have to be accountable to us, or we will leave. We’ll go to another government and will pay them our taxes.

So governments are doing their best to attract the startups, the brains, the best, and the brightest. Another place China’s made a huge mistake was when they slapped down the Bitcoin exchanges. And when they did that, there was a huge brain drain out to Japan, because Japan said, we’re going to make Bitcoin a national currency…boy, all the best entrepreneurs from China fled to Japan!”

Backing iconic fintechs like Robinhood, Carta, Forge, and AngelList

“[Robinhood] said we talked to at least 25 investors, and Draper was the only one stupid enough to invest in us!”

“[Sarbanes-Oxley] had quintupled or even 10x’d the amount of money that it cost for a public company to comply with all the regulations...So I started to look around and thought, Well, maybe people should be trading these companies privately…so I backed Carta. And I thought eventually they’ll be able to trade private stock more…So I backed Forge…I backed Robinhood, because it was a way that individual investors could start to participate in financial accrual and the economic growth of a country. And I backed Angel List because they were doing it at the seed level.”

Where entrepreneurs need to focus moving forward

“I would look for places where the provider, country, or company is providing bad service at a high cost. And they’re working with the other competitors to set prices…What industries have that criteria? Big Pharma, the drug companies, big banks, big four accounting. Anytime it’s ‘big’, you’ve got an oligopoly and it’s ripe for an entrepreneur…

What happens when an entrepreneur comes in, they not only provide better service, but they force those people in that oligopoly to also provide a better service. So everybody benefits! And then insurance, they’re operating at a total oligopoly event. So insurance is going to go through a major transformation next!”

A fun rapid-fire round including the first bank branch in space (Coinbase) and his updated bitcoin price target (holding at $250k by 2023!)

and much more!

Listen on Apple | Spotify | Soundcloud

—

About Tim Draper:

Tim Draper is a prominent Silicon Valley venture capitalist and founder of Draper Associates, DFJ, and the Draper Venture Network, a global network of venture capital funds. The firms’ investments include Baidu, Focus Media, YeePay, KongZhong, Skype, Hotmail, Tesla, SolarCity, Coinbase, Ledger, Robinhood, Athenahealth, Box, TwitchTV, SpaceX, Cruise Automation, Carta, Planet, PTC, and many others.

Tim is a leading spokesperson for Bitcoin, Blockchain, ICOs, and cryptocurrencies. He won the US Marshall’s auction in 2014 (where he bid on 50,000 bitcoins) and invests in over 50 crypto companies as well as leads investments in Coinbase, Ledger, Tezos, and Bancor, among others. He created viral marketing, a marketing method for exponentially spreading an electronic service from customer to customer, that was instrumental to the successes of Hotmail, Skype, and other applications.

Tim is regularly featured on major networks, in publications, and in social media as a proponent for entrepreneurship, innovative governance, free markets, and Bitcoin. He has received various awards and honors including the World Entrepreneurship Forum’s “Entrepreneur of the World.” He has also been highly ranked on several notable lists including one of the top 100 most powerful people in finance by Worth Magazine, the top 20 most influential people in Crypto by Crypto Weekly, #1 most networked venture capitalist by AlwaysOn, #7 on the Forbes Midas List, and #48 most influential Harvard Alum.

In his mission to promote entrepreneurship, Tim created Draper University of Heroes, a residential and online school based in San Mateo, California, to help extraordinary people accomplish their life missions. School alumni have gone on to build 350 companies including crypto leaders, QTUM, Spacecash, DataWallet, and Credo. He also started Innovate Your State, a non-profit dedicated to crowdsource innovation in government; and BizWorld, a non-profit that teaches young children how business and entrepreneurship work.

Tim is involved in California politics and education/organizations, having served on the California State Board of Education and starting a movement for local choice in schools that led to him becoming a proponent for a statewide initiative for school vouchers. He also led a statewide initiative to create competitive governance with Six Californias, followed by an initiative for Three Californias.

Tim received a Bachelor of Science from Stanford University with a major in electrical engineering and a Master of Business Administration from the Harvard Business School. He also has two honorary doctorates from The International University and Trinity College of Dublin.

—

Y Combinator’s Michael Seibel & Dalton Caldwell — Lessons from 5000 Entrepreneurs

Mayor Francis Suarez — Bringing Silicon Valley to Miami!

11:FS Co-Founder Simon Taylor — NFTs, Clubhouse, & The State of Crypto

Lex Sokolin, ConsenSys CMO & Fintech Futurist — Fintech Trends, Defi, & Digital Collectibles

TaxBit Brothers Austin & Justin Woodward — Solving Crypto’s Tax Problem & A $100M Series A!

Noah Kerner, CEO of Acorns — Leveling the Investment Playing Field

Jeff Immelt, Former GE CEO — Globalization, Crisis Leadership, & 16 Years at The Top

Anish Acharya, General Partner at Andreessen Horowitz — Doubling Down on Fintech

Robinhood’s COO, Gretchen Howard — Democratizing Finance, Navigating a Crisis, & Embracing Change

Frank Rotman, Founding Partner at QED Investors — Past, Present, and Future of Fintech!

Crypto Comes to India with Neeraj Khandelwal, Co-Founder of CoinDCX

—

Ryan Zauk is an MBA Candidate at The Wharton School, where he runs the Wharton FinTech Podcast. He currently works with the US International Development Finance Corp looking at technology impact investments in developing markets. He has a passion for music, media, and all things FinTech.

You can reach him at rzauk@wharton.upenn.edu or on Twitter.

—

Miguel Armaza is Co-Host of the Wharton Fintech Podcast and Co-Founder of Gilgamesh Ventures, a seed-stage investment fund focused on fintech in the Americas.