Ali Tamaseb, Partner at DCVC - What Does It Really Take to Build a Unicorn?

This article is part of Fintech Leaders, a newsletter with over 20,000 dreamers, entrepreneurs, investors, and students of financial services. I invite you to share and sign up here: Substack

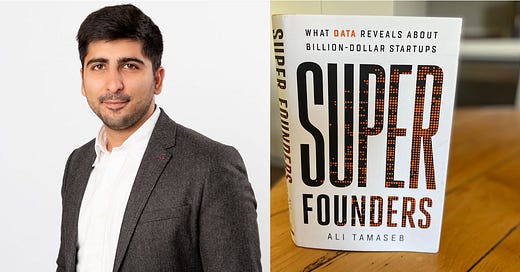

I sat down with Ali Tamaseb, Partner at DCVC, a VC fund that backs teams applying deep tech to transform giant industries. Ali is also a published author, having recently authored Super Founders: What Data Reveals About Billion-Dollar Startups, a book that uses a data-driven approach to understand what really differentiates billion-dollar startups from the rest—revealing that nearly everything we thought was true about them is actually false.

Ali began this project four years ago, trying to answer a single question: what was different, if anything, between startups that go on to become billion-dollar successes and those that raise VC funding but don’t succeed in that scale? Thousands of hours later, having manually collected 30,000+ data points, he was shocked with the result. The data rejected so many popular narratives that he decided to write a book based on the findings.

In the process, Ali interviewed founders of many billion-dollar companies like Zoom, Instacart, GitHub, and Nest, as well as investors like Alfred Lin, Elad Gil, and Keith Rabois. Ali learned plenty of lessons through these interviews and their stories were full of inspiration and a reminder that there are years of unnoticed ups and downs before every “overnight success”. Small successes are great preparations for much bigger outcomes in startup land.

The book is full of counterintuitive lessons and inside stories from founders of some of the most successful companies in the industry and highly recommended for those interested in the ingredients of successful startups.

Ali Tamaseb

Ali brings the perspective of an entrepreneur and previous startup founder, as well as a highly technical academic researcher to DCVC. Ali has walked in the shoes of many of the scientist-turned-entrepreneurs that we back and has first-hand experience with the challenges they face. At DCVC, he works on a broad spectrum of areas ranging from computational health/bio to cybersecurity. More specifically, Ali likes to identify early-stage highly technical and defensible startups in diagnostics tools, neuro-technology, precision medicine, synthetic bio and bio-logic, disruptive healthcare models, financial technologies, alternative data, next-generation computing, cryptography and blockchain.

Ali received a B.Eng. in Biomedical Engineering from Imperial College London and graduated from the SIGM program at Stanford Graduate School of Business. He did research in the fields of neuroscience and human-computer interaction. Ali has 6 publications, including one book, holds a number of patents, and has won medals in national and international olympiads and innovation fairs. Ali was an honoree of the British Alumni Award, and Imperial College President’s Medal for Outstanding Achievement. Ali and his work has been featured in BBC, Guardian, Forbes, The Telegraph, and others. Ali has given talks and been on panels at major events and conferences including two TEDx talks.

Previous Episodes You May Enjoy:

Reinventing Financial Systems – Henrique Dubugras, Co-Founder/Co-CEO of Brex

Building a Customer-Centric Culture with David Vélez, Founder and CEO of Nubank

Jackie Reses - Leadership Lessons, Fintech Innovation, & Helping Small Businesses

Creating an African Fintech Giant - Olugbenga Agboola, Co-Founder & CEO of Flutterwave

Building Unicorns and Redefining Online Banking - Renaud Laplanche, Upgrade CEO/Co-Founder

Y Combinator's Michael Seibel & Dalton Caldwell - Lessons from 5000 Entrepreneurs

Miguel Armaza is Co-Host of the Wharton Fintech Podcast and Co-Founder of Gilgamesh Ventures, a seed-stage investment fund focused on fintech in the Americas.