This article is part of Fintech Leaders, a newsletter with over 30,000 dreamers, entrepreneurs, investors, and students of financial services. I invite you to share and sign up here!

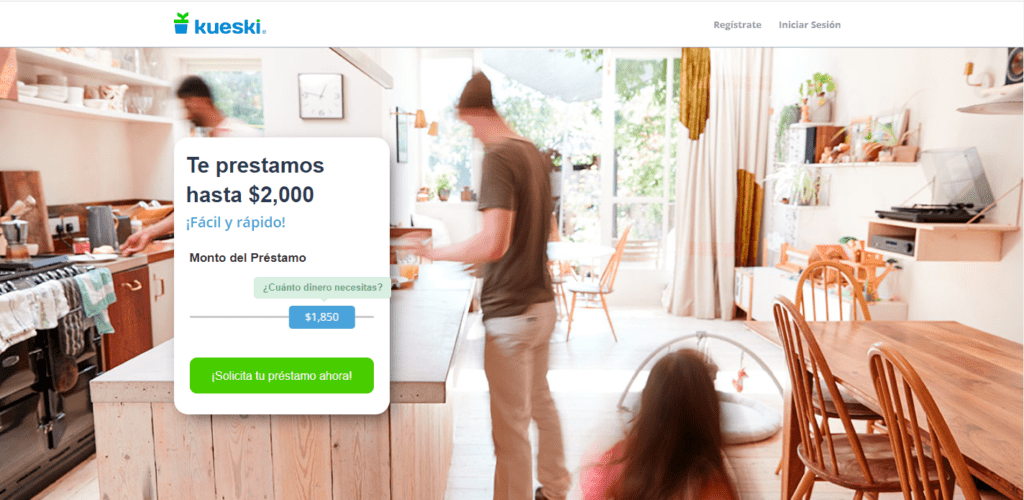

In this Fintech Leaders edition, I sit down with Adalberto Flores, Founder and CEO of Kueski, a Guadalajara-based “buy now, pay later” and online consumer lender, and one of LatAm’s Fintech OGs.

Since inception in 2012, Kueski has issued more than 5 million loans online and has raised over $300 million from Altos Ventures, Core Ventures Group, Angel Ventures, Cathay Innovation, and many more.

In this episode, we discuss:

Challenges and lessons for founders in tough raising environments and emerging markets, and how Adal managed to raise Seed capital back in 2012.

“Back in those early days, it was just so difficult to raise capital. I remember when we were pitching investors, the vast majority of investors didn't even respond our emails.”

Importance of culture-building and how you can use your company culture to attract high-quality talent

"Culture is about discipline. Culture is seeing a candidate that you want to recruit, and not moving forward, because you believe that candidate is not going to be adding to your culture, that actually requires discipline."

State of BNPL in Mexico and how Kueski is using this product to enable the 60% unbanked population of the country to access the financial system and start building credit

“We can enable 60% of the population of Mexico to integrate themselves into the digital economy and make sure that they can pay… We are enabling customers to Buy Now and Pay Later. No bank account required, no interest rate, no down payment, and no interest… We charge the merchant a transaction fee.”

Why Guadalajara is known for Tequila, Mariachis, and Technology and how it became the Silicon Valley of Mexico… and a lot more!

“This is the place where tequila and mariachis were born. And it's known to be the Mexican Silicon Valley. So it's Tequila, Mariachis, and technology.

Want more podcast episodes? Join me and follow Fintech Leaders today on Apple, Spotify, or your favorite podcast app for weekly conversations with today’s global leaders that will dominate the 21st century in fintech, business, and beyond.

Emerging Fintech Leaders

Want to break onto the fintech scene with a feature in our newsletter? Introduce us to your startup! You can also find the full list of featured companies here.

Three early-stage fintech companies doing amazing things

☎️ FONBNK (@fonbnk1 on Twitter)

Fonbnk allows users of prepaid phones to monetize their extra airtime. Unbanked users gain an on-ramp to digital money by converting SIM cards to prepaid debit cards or digital tokens using the company’s technology. Beginning with Africa, the friction-free option is providing an innovative solution for mobile-first economies in emerging markets.

💰Funding Status: Fonbnk raised $120K in pre-seed capital from the Western Union Fintech Accelerator and has also secured an undisclosed amount of seed capital from Allied Venture Partners, according to Crunchbase.

👤 Founder: Christian Duffus (LinkedIn / Twitter @cduffus)

📣CROWD CAPITAL (@CrowdCapitalP)

Crowd Capital gives families with mortgages in distress a second chance to keep their homes, while still delivering attractive returns for their investors. The firm guides borrowers at risk of foreclosures through the loan modification process after purchasing their debt at a discount. So far, Crowd Capital has helped over 250 families keep their home while delivering steady passive income to investors. Investors no longer have to choose between social responsibility and solid returns because the Crowd Capital Fund offers both.

💰Funding Status: Crowd Capital was accepted into FinHealth’s US 2021 Accelerator cohort. The company has yet to raise any outside capital publicly.

👤 Founder: Christian Rotter (LinkedIn / Twitter)

🦁 NALA (@NALAmoney on Twitter)

NALA is a Tanzanian cross-border payments fintech serving the African diaspora. Though it started as a local money-transfer business within Africa, the company has since pivoted strongly into the remittance and international payments space. NALA is soon to expand to the U.S. and EU to serve a greater share of the African diaspora as a sender and storer of foreign currencies.

💰Funding Status: In late January, NALA raised $10M in a seed round led by Amplo, and joined by Accel, Bessemer, and an impressive group of angels that included Robinhood founder Vladimir Tenev.

👤 Founder: Benjamin Fernandes (LinkedIn / Twitter)

Want to break onto the fintech scene with a feature in our newsletter? Introduce us to your startup! You can also find the full list of featured companies here.

-Thank you for reading!

Previous Episodes You May Enjoy:

Miguel Armaza is Co-Founder & Managing General Partner of Gilgamesh Ventures, a seed-stage investment fund focused on fintech in the Americas. He also hosts and writes the Fintech Leaders podcast and newsletter.

Adalberto Flores, Founder/CEO of Kueski - Tequila, Mariachis, & Technology